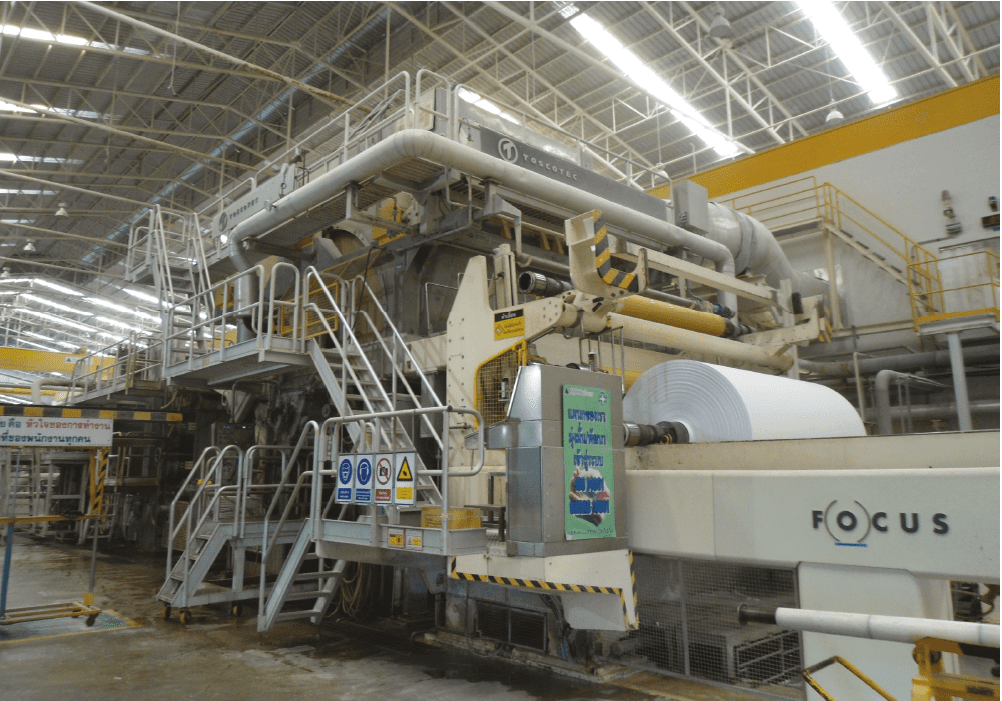

BANGKOK, Thailand: From June 6-8, 2018 the Asian Paper & Tissue World Bangkok 2018, the first pan-Asian event of its kind will bring together paper, packaging and tissue product makers and suppliers from around the world under one roof in the Thai capital. The event’s overarching theme will be Shaping Success: Strategies for Sustainable Growth in Paper, Packaging and Tissue and aims to address the key factors influencing the industry’s direction.

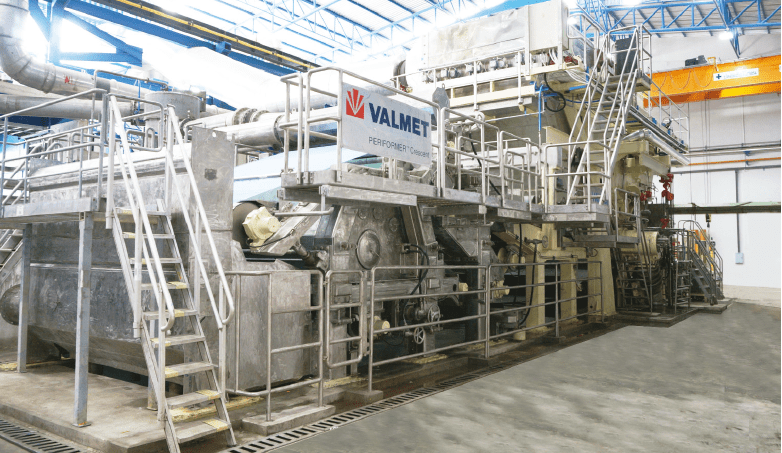

Held at BITEC Bangkok, the Asian Paper and Tissue World 2018 exhibition and conference will attract some of the world’s largest and most esteemed manufacturers from over twenty different countries. This year, they will include Valmet Co., Ltd. (Thailand), Xiamen C&D Paper & Pulp Co., Ltd. (China) and AkzoNobel Specialty Chemicals (Sweden) among others.

Apart from the participation in the exhibition, these companies’ senior representatives will also join in this year’s Senior Management Symposium on 6 June. During these high-level seminars, key performance variables which define success in the industry will be analyzed. They will include topics such as sustainable growth and innovations, fiber resources, trends and outlooks in the corrugated carton industry, machine conversions, IoT, as well as cutting-edge paper and board multi-client studies. Featured speakers on these subjects are Mr. Wichan Jitpukdee, President of TPPIA, Thailand; Mr. Haidong Wang, Head of Strategy at Xiamen C&D Paper & Pulp Co., Ltd., China and Mr. Jukka Luoto, Paper Technology Manager – Asia Pacific Area for Valmet Co., Ltd., Thailand.

Following the symposium, the New Applied Technology Sessions on 8 – 9 June will take place. Key industry players will discuss matters such as practical solutions to save costs on the newest fiber trends, reduction of water usage in ECF bleaching, nanotechnology as well as Industry 4.0 to increase production efficiency and product quality. Speakers include Mr. Mikko Jalava, Sales Director at ABB Oy, Finland, Ms. Eva Wackerberg, Applications RD&I Manager at AkzoNobel Specialty Chemicals, Sweden and Dr. Mahendra Patel, Technical Adviser with Indian Agro and Recycled Paper Mills Association, India.

“Today, tissue is ascendant and the need for innovative packaging is boosted by evolving consumer habits. Graphics and other specialty areas will continue to gain importance. The Asian Paper and Tissue World 2018 will explore the factors which will determine the industry’s trajectory and how to optimize manufacturing processes and the use of resources to achieve sustainable growth, create high-quality products and save costs. By bringing together the industry’s top players, the conference offers attendees an exclusive platform for learning and business exchange in this fast-changing and growing industry,” says Agnes Gehot, deputy event director of Asian Paper & Tissue World, UBM Exhibition Singapore.

Asian Paper and Tissue World Bangkok 2018 is supported by the following associations:

- The Thai Pulp and Paper Industries Association (TPPIA)

- Australian and New Zealand Pulp and Paper Industry Technical Association (APPITA)

- The Association of Indonesia Pulp and Paper Industries (APKI)

- Chinese Taipei Paper Industry Association (CTPIA)

- Indian Agro & Recycled Paper Mills Association (IARPMA)

- Japan Technical Association of the Pulp and Paper Industry (JTAPPI)

- Myanmar Pulp and Paper Industry Association (MPPIA)

- Malaysia Pulp and Paper Manufacturers Association (MPPMA)

- Technical Association of the Pulp and Paper Industry of Southern Africa (TAPPSA)

Visitor and conference registration is now open. For more details, visit www.asianpapershow.com.

# # #

For further information and images please contact:

Karin Lohitnavy

Midas Communications International Co, Ltd.

E-mail: karin@midas-pr.com

Phone: +66 86 044 2145

Website: www.midas-pr.com

About Asian Paper – Established since 1992

Asian Paper is the largest ASEAN event serving the global pulp, paper, packaging and related industries. It gathers key industry players to meet face to face and discuss the latest innovation, industry trends and offerings of cutting-edge products and services through its exhibition and conference. The Asian Paper exhibition focuses on the Paper industry, covering the entire value chain, from pulp, chemical, adhesive, machinery, parts, converters to paper and packaging products and services across the three-day event.

About Tissue World – Established since 1993

Tissue World is the leading global event serving the tissue industry worldwide. With trade shows in Istanbul, Milan, Miami, São Paulo and Bangkok, it offers an integrated platform consisting of exhibitors, conferences and a magazine providing an unmatched offline and online place to do business, exchange ideas and learn, all year around.

About UBM

UBM Plc. is the largest pure-play B2B Events organizer in the world. In an increasingly digital world, the value of connecting on a meaningful, human level has never been more important. At UBM, our deep knowledge and passion for the industry sectors we serve allow us to create valuable experiences where people can succeed. At our events, people build relationships, close deals and grow their businesses. Our 3,750+ people, based in more than 20 countries, serve more than 50 different sectors – from fashion to pharmaceutical ingredients. These global networks, skilled, passionate people and market-leading events provide exciting opportunities for business people to achieve their ambitions.